The insolent margins of tricolor luxury - Capital.fr

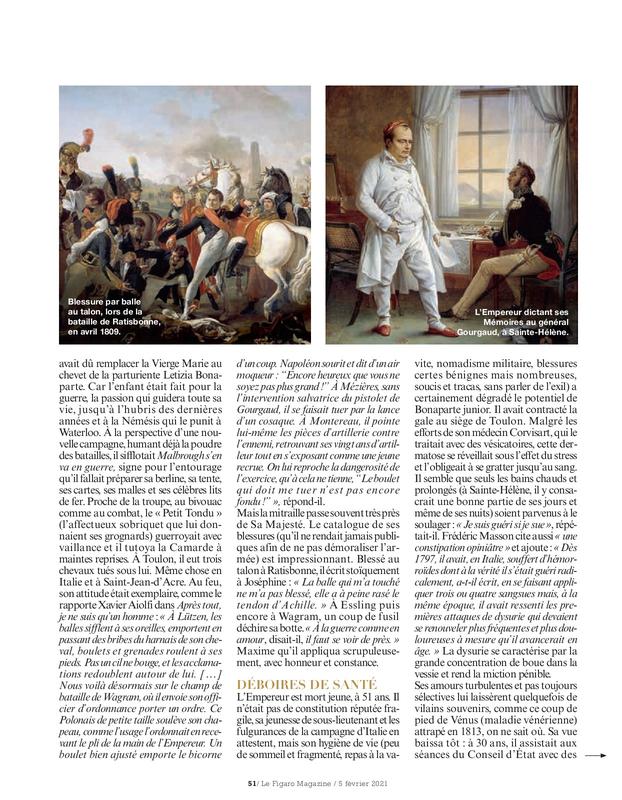

Hermès, Kering, LVMH...The three French luxury giants completed 2017 on insolent margins, sometimes exceeding 30%, a profitability which owes more to a skillful cost management than to price increases, according to analysts in the sector.Particularly scrutinized, the operating margin of a group provides the profitability of its sales, but also its ability to control costs.At the top of the 2017 prize list, Hermès completed his year on a "record" margin of 34.6% - up two points over a year."This exceptional progression results mainly from the success of the collections, the very good productivity of production sites and the positive impact of exchange covers," summed up the Sellier-Maroquerier on Wednesday, when it is published in its annual results.

He is closely followed by the Italian nugget of the Kering group, Gucci, "whose profitability has reached a historic level of 34.2%" of sales, said in February Jean-Marc Duplaix, financial director of Kering.But another brand is certainly defeated Hermès and Gucci à Plature with regard to the margins: Louis Vuitton, mastodon of the LVMH group, with financial performance kept secret but whose profitability would be around 40% according to the estimates of analysts.

>> A lire aussi - C’est le moment d’investir dans le luxe, voici comment

"These are unique margins, even demented.It is on silk and especially leather that these brands make huge margin rates. Et c'est parce qu'elles vendent de plus en plus de cuir et de soie que le taux de marge progresse aussi bien", résume à l'AFP Arnaud Cadart, gérant de portefeuilles chez Flornoy & Associés.It also highlights "the efficiency and vigilance" of the French luxury giants in the face of economic hazards, such as the slowdown in Chinese growth in 2012."These are professionals of the +business +, and the more boxes managed at the +Papy +from the beginning of the 20th century".

Various factors favor these margins, adds Luca Solca, analyst at Exane BNP Paribas: "High organic growth that shows that companies have cautiously managed costs, an increase in productivity per m2 because they have stopped opening"All round" new stores, and online sales development that have even more interesting margins ".

"But the price lever did not contribute a lot to the increase in profits" in 2017, would like to emphasize Luca Solca."The prices no longer increase a lot; they had increased a lot with the rise of Chinese customers, but for three or four years, brands have been going on that has been unmolding on the increases and they do not exaggerate too much, even if the latitude remainsstill huge, "adds Arnaud Cadart."There has been little price effects," also insisted the president of Hermès, Axel Dumas on Wednesday, stressing that the group's growth "is essentially based on volumes, and is therefore healthy and virtuous"."Hermès products are worth very expensive but the raw material is also very significant," said Jérôme Sanchez, manager at Vega IM, who emphasizes that the Maison du Faubourg Saint-Honoré "still lives on the Birkin andKelly ", its historical models.

It remains to be seen whether the sector, Hermès in mind, has reached its maximum in terms of operational margin: "We can always do better, but that would mean sacrifice investments for the future, so nobody risks there,"Jérôme Sanchez.According to him, "there is a threshold from which it would be a leap into the unknown, and these groups are conglomerates so they use these brands (with high margin, editor's note) to finance their other brands to revive"".For Luca Solca, the limit is "the moment when the consumer begins to ask questions about the value for money.Erosion can occur over time, and it is an aspect to which brands must be attentive ".

>> En vidéo - Défilés parisiens : les héroïnes conquérantes de Vuitton

- Prev

- Next