LVMH, Hermès, Kering: what prospects for 2022 for luxury stocks? information provided by Café de la Bourse•02/12/2021 at 14:42

(Photo credits: Flickr - Faisal Althani)

In this article, we are interested in the 2022 outlook for French luxury champions. After many ups and downs in 2021 (volatility, post-lockdown recovery, Chinese market regulation announcements, etc.) what can we expect in 2022 from LVMH shares, Kering shares and Hermès shares? Café de la Bourse shares its reading of the market with you.

Luxury: what to expect from the end of 2021?

The year 2021 was eventful for luxury players, mainly under the threat of a drop in demand in China. Indeed, China's economy grew at its slowest in a year in the third quarter, hurt by power shortages, supply chain bottlenecks and the COVID-19 outbreak. In addition, remember that Xi Jinping announced economic regulation measures this summer against various sectors, and in favor of a better redistribution of wealth. In this context, the shares of French luxury companies LVMH, Kering and Hermès, which are very exposed to China, sometimes fell by more than 5% in a handful of sessions.

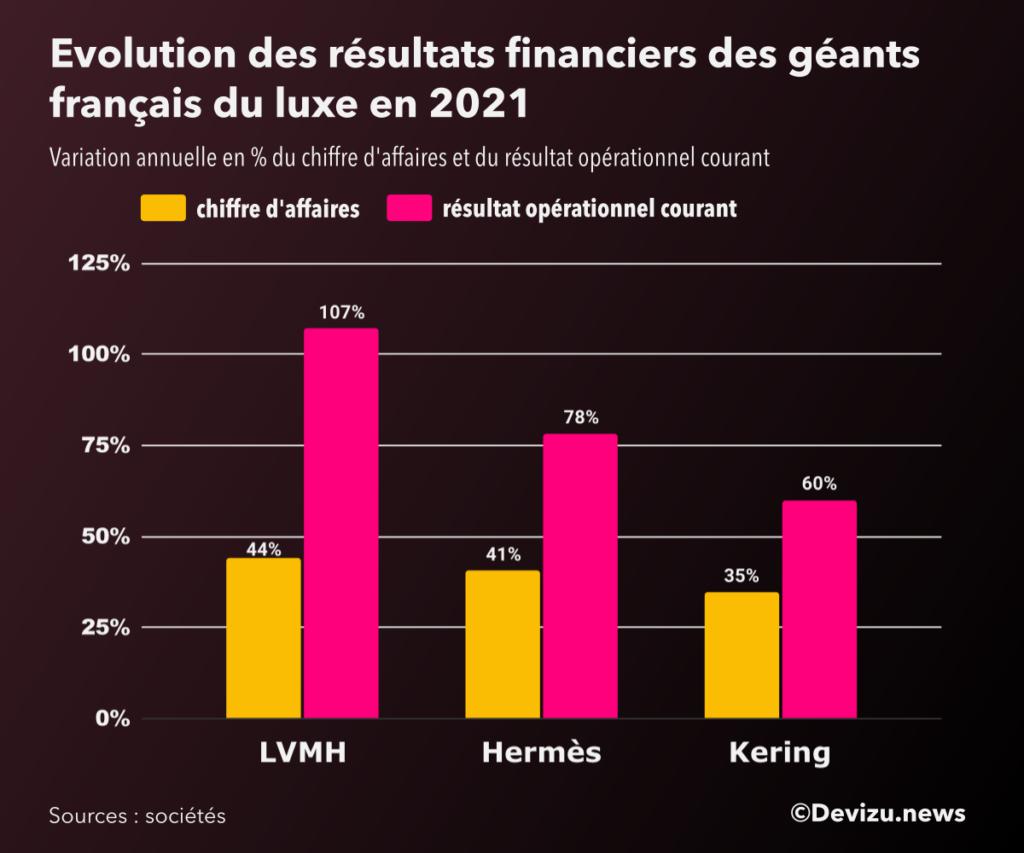

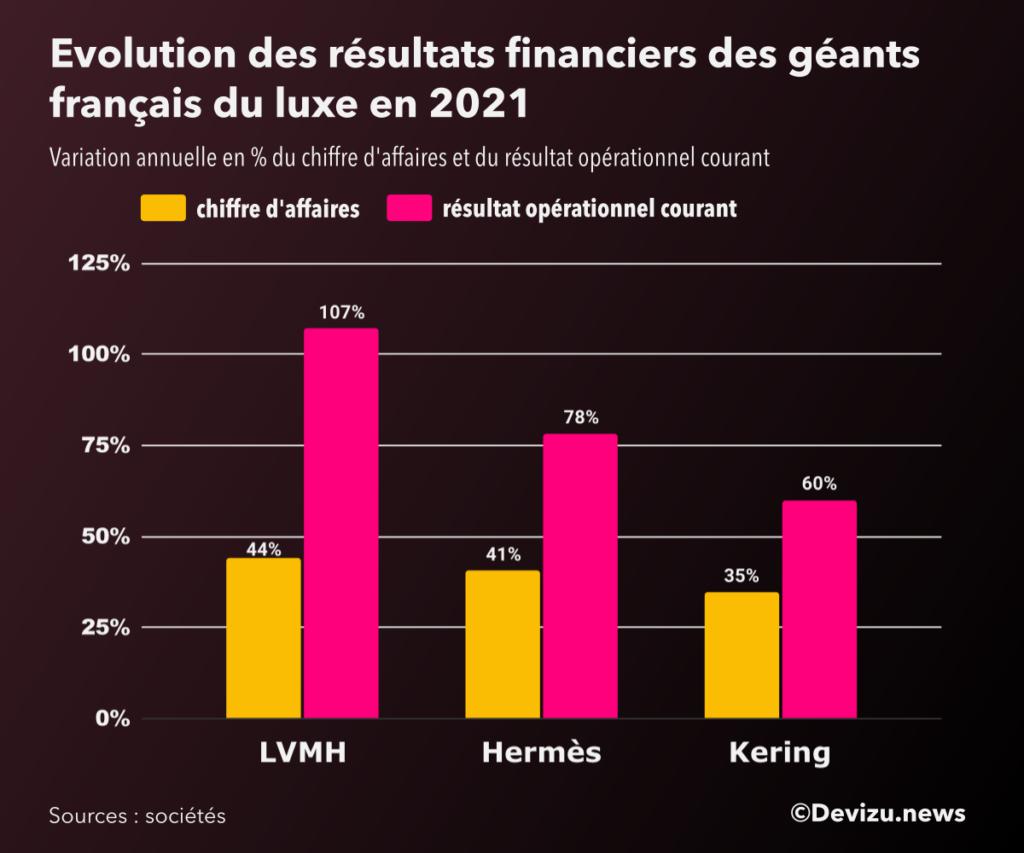

Between January 1, 2021 and November 27, 2021, Kering is up 12%, Hermès up 81% and LVMH up 35%. Hermès and LVMH achieved very good performances after having reassured the market during the publications of the third quarter. LVMH showed great resilience in its revenue mix and Hermès demonstrated the immortality of the Birkin bag and its leather goods branch. Kering, on the other hand, is suffering from its high exposure to its flagship brand Gucci, which has underperformed market expectations.

Read also: Is the Hermès Birkin a form of investment?

What to expect from the end of the year? The appearance of the new Omicron variant in South Africa and the return of restrictive measures to curb the pandemic could bring back uncertainty and volatility. Hermès, LVMH and Kering fell 3%, 6% and 7.5% respectively on Friday November 26. It is possible that the COVID will once again send Luxury back to its 22nd… The end-of-year publications will be eagerly awaited.

2022 outlook for the Hermès share

The Hermès share is the one that has made the most progress on the stock market in 2021. The highly integrated artisanal model, the balanced distribution network, the creativity of the collections and the loyalty of the customers give confidence to the market. Hermès has a unique know-how in leather goods which seems to make the company impervious to macroeconomic bad weather.

Sales of Leather Goods & Saddlery are expected to benefit from strong deliveries thanks to very sustained demand. Hermès will also increase its production capacities, with the leather goods factory in Louviers (Eure) planned for 2022, that of Sormonne (Ardennes) by 2023 and a new site in Riom (Puy-de-Dôme) for 2024.

Hermès is expected to grow by 12% over the year 2022, for a turnover which should exceed 10 billion euros. The financial resilience of Hermès comes at a high price. Today the valuation of the Hermès share on the stock market stands at 18.2x its turnover, and 72.5x its profits.

LVMH share outlook for 2022

World leader in the luxury market, the diversification of its product offering allows LVMH to boast the most defensive profile of companies in the luxury industry. The group's turnover is evenly distributed geographically, the solid financial position and the family shareholding (the Arnault family holds 47% of the capital) ensure a coherent strategy over the medium and long term, as well as lower compared to its competitors, such as Kering for example.

During the pandemic, LVMH has invested in two major luxury brands. He bought Tiffany in January 2021, bolstering LVMH's jewelry business. In August 2021, LVMH took a different direction by taking a majority stake in Off-White, a pioneering streetwear brand. These two investments are emblematic of the diversification that LVMH has integrated into its activities, ensuring that its brands can appeal to both consumers with classic and avant-garde tastes.

LVMH's turnover is expected to grow by 11% in 2022, to reach 68 billion euros. The valuation of the LVMH share on the stock market amounts to 5.8x its turnover and 32.8x the profits.

Kering share outlook for 2022

Kering is in the spotlight with its wish to reconcile with Richemont, even if for the moment Richemont refuses the marriage. The merger of the two luxury groups makes sense: Richemont specializes in “hard luxury”, ie watches and jewelry, while Kering is one of the leaders in “soft luxury” with Gucci and Saint Laurent.

Kering is expected to turn however on its growth. Gucci sales need to catch up in 2021 and outperform going forward to reassure the market.

The interesting point of Kering is its valuation. With a valuation of the Kering share on the stock market of 5.16x the turnover and 26.8x the profits, Kering offers a nice discount of almost 20% compared to its rival LVMH.

Kering's turnover is expected to grow by 10% in 2022, to reach 18.5 billion euros.

What is the outlook for the luxury sector in 2022?

The global luxury goods market is worth 283 billion euros and is expected to grow to 360-380 billion euros by 2025, when young people are expected to make up 70% of customers, according to consultancy Bain & Company.

Nevertheless, concerns about the Chinese market are still hovering... The country's authorities have indeed announced their desire to redistribute wealth and "common prosperity". The threat that foreign luxury goods will be stigmatized by the Chinese authorities and that new taxes will be put in place is very real.

On the other hand, the luxury giants have the undeniable advantage of benefiting from excellent pricing power which guarantees them high margins. They benefit and will benefit from the explosion of the middle classes in Asia, the most demanding of luxury items, gradually dropping the “ultra rich” if they are to disappear.

Also find this article on Café de la Bourse

- Prev

- Next