Voyages: What to declare to customs |Family file

Holidays: formalities not to be overlooked

After a stay abroad, it is possible to report goods, often in limited quantities or sometimes by paying customs duties.

6 min de lectureThis content has been added to your favorites

Voir mes favorisThis content has been deleted from your favorites

Voir mes favorisTo add this content to your favorites you must be connected

Me connecterTo add this content to your favorites you must be subscribed

M'abonnerCigarettes, jewelry, perfume, camcorder, bottles of alcohol ... There are many travelers who come back from their trip with some memories in their luggage, bought for them or their loved ones.Distrust all the same by passing customs, because, according to the resort, the import rules are not the same.

Declaration to customs: for what goods?

Inside the European Union, French nationals can normally pass customs in peace.This is the principle of free movement of goods that applies.But the rules differ for other countries.

Back from a non-member of the European Union, French tourists must first face the ritual question of customs officers: "Do you have goods to declare?"

The answer will then depend on the resort, nature and quantity of reported objects.Trying to hide a brand new golf bag and its complete series of clubs purchased at half price in the United States can, for example, cost quite expensive: in addition to the rights and taxes that it must pay, the controlled offender runs a fine… For lack of declaration!

Limited alcohol and tobacco in the European Union

No customs and fiscal formalism is necessary for the goods acquired in one of the twenty-seven member states of the European Union, as long as these purchases are intended for exclusively personal use.A French national is therefore free to report without accounting for as many memories as they wish, the rights and taxes having already been paid in the country of purchase (the invoice attesting).

However, quantitative thresholds have been fixed for certain goods, such as tobacco or alcohol.Beyond these quantities, customs agents assume that the purchase is of a commercial character.The tourist must then pay the various rights and taxes applicable in France for each of these products.

No more than 430 € for travelers

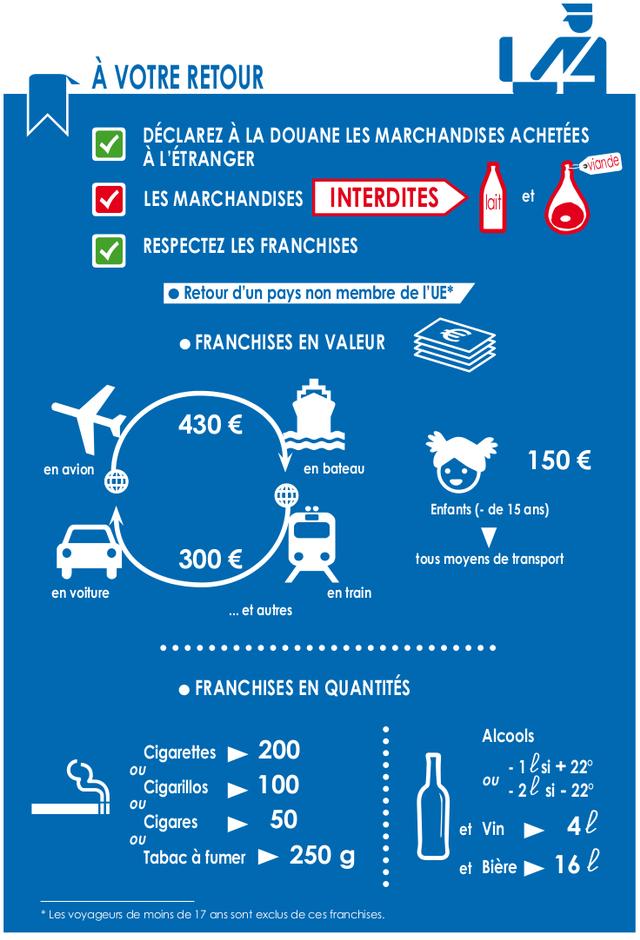

The system is different when the purchase of goods is carried out in a country who is not a member of the European Union (which includes DOM-TOM).The vacationer benefits in this case from franchises in value which allow him to report his shopping without any particular formality (neither declaration, nor rights or taxes to be settled).

Merchant all the same: the value of these goods should not exceed € 430 for travelers aged 15 and over (air and sea), or 300 euros (other means of transport) and € 150 for travelers under 15 years of age.

Attention !These sums cannot be accumulated by different people for the same object.Do not count, for example, bringing a 12 -year -old camera with your spouse and a camera of € 1000 [(430 x 2) + 150] without paying taxes with your spouse and child..Because, beyond these amounts, customs duties and VAT (at the French rate) calculated on the value of the goods will necessarily be due.

There is no single rate: each item is applied to a clean rate according to a pricing code.Finally, specific franchises also apply here to certain products, such as tobacco or alcohol.

Free movement card: the passenger passport

In addition, a French tourist must always be able to prove to customs officials that he is in regular situation for all the other objects he carries (jewelry, professional laptop ...).

Also, in order to avoid having all the invoices and other cash tickets on your personal effects on yourself, at the risk of forgetting it, it is better to have a free traffic card established before its departure.

A real passport of the goods with which we travel, it is free and valid for ten years (and renewable).Those who wish can obtain it in any customs office by presenting their objects accompanied by supporting documents for their purchase (invoices, guarantee certificates, etc.).

Attention !The free movement card must be completed as it is acquired, always in the same office.

Declare the sums of money beyond € 10,000

Finally, whatever the provenance or the destination (country of the European Union or not) of a French national, he must declare to customs agents the sums, securities or values that he carries whether their amount is equal or higherat 10,000 €.It does not matter that these are species, checks, ingots, gold or silver pieces, vacuum checks ... These controls are used to fight against money laundering from illicit traffic, in particularnarcotics.

In practice, the French tourist who travels to the European Union must make his declaration at least five days before the start of his trip to the Regional Directorate of Customs and Indirect Rights of the place of his home.On the other hand, if he visits a country who is not a member of the European Union, the formalities are at the service of customs during the border passage.

Where to learn?

Several solutions to find the information:

False declaration: customs fines to the key

If customs officials control a French tourist with more products than what is authorized (or in the absence of a declaration or false declaration), the latter faces a customs fines, or even legal proceedings.

The importance of the sanction depends on its good faith and the quantity of products fraudulently imported.In the event of possession of counterfeits or prohibited products, the goods will be systematically confiscated.

Franchises granted to travelers

| Produits et marchandises | Quantité maximale autorisée de retour d’un pays membre de l’UE | Quantité maximale autorisée de retour d’un pays tiers (1) | Cas particulier d’Andorre |

Tobacco (2) | |||

| Cigarettes | 800 pièces | 200 pièces | 300 pièces |

| Cigarillos | 400 pièces | 100 pièces | 150 pièces |

| Cigares | 200 pièces | 50 pièces | 75 pièces |

| Tabac à fumer | 1 kg | 250 g | 400 g |

| Café | No limitation | 500 g | 1 kg |

| Extraits et essences de café | No limitation | 200 g | 400 g |

Tea | No limitation | 100 g | 200 g |

| Extraits et essences de thé | No limitation | 40 g | 80 g |

| Alcools | • Boissons spiritueuses (whisky, gin, vodka) : 10 l• Boissons intermédiaires (porto, vermouth, madère) : 20 l• Vins (dont 60 l maximum de mousseux) : 90 l• Bières : 110 l | • Quiet wines (non -sparkling): 4 L • Drinks titling more than 22 °: 1 L • Drinks titling 22 ° or less: 2 L • Beers: 16 L | • Vins tranquilles (non mousseux) : 5 l • Boissons titrant plus de 22° : 1,5 l• Boissons titrant 22° ou moins : 3 l |

| Parfums | No limitation | 50 g | 75 g |

| Eaux de toilette | No limitation | 25 cl | 37,5 cl |

(1) Including the Anglo-Norman Islands, Canaries, Dom, Guyana and Reunion.

(2) 17 -year -old minors (even with an adult) cannot import tobacco, nor alcoholic drinks.

A lire aussiAuteur : Frederique lehmannArticle publié leDans le dossier Holidays: formalities not to be overlooked- Prev

- Next